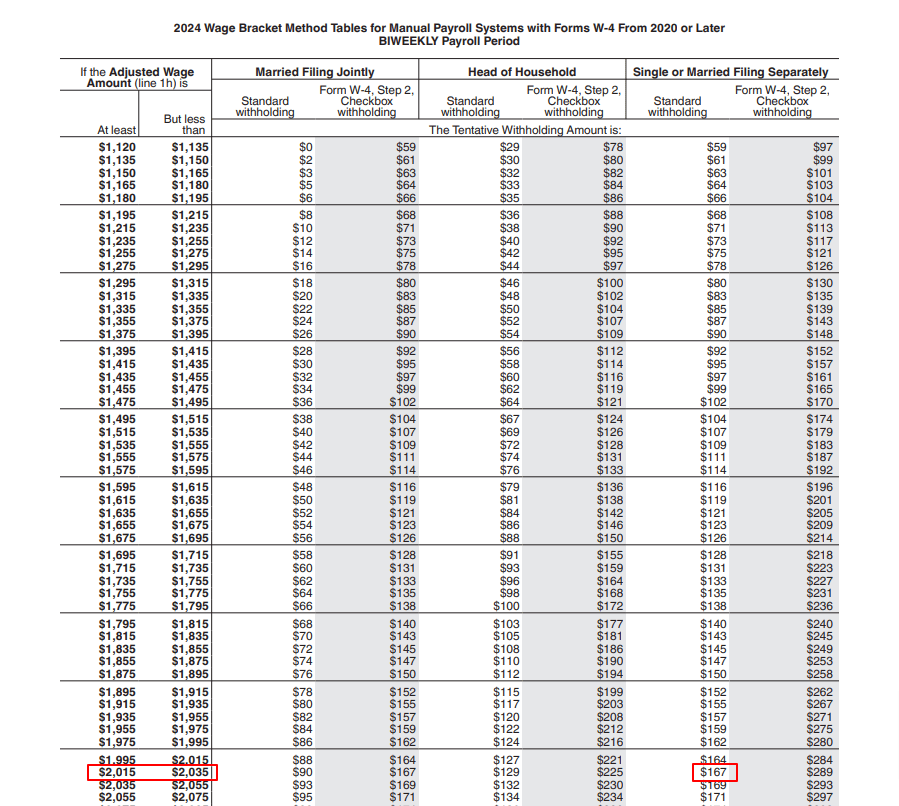

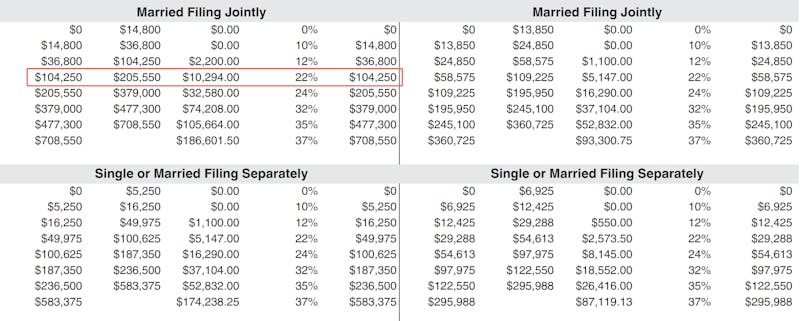

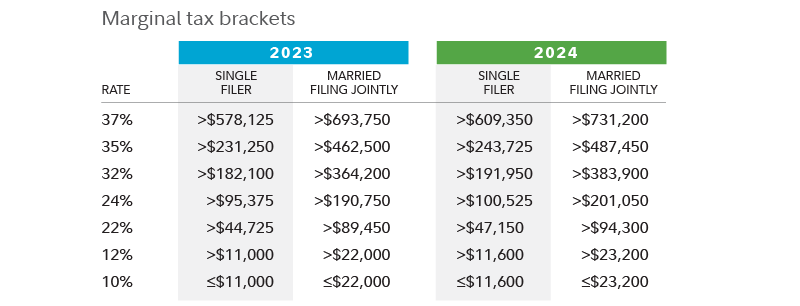

Federal Tax Withholding Tables 2024 Changes – The new year brings new tax brackets, deductions, and limits that will impact your 2024 federal income tax return across income levels and will change how much you owe or your refund amount. . The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have .

Federal Tax Withholding Tables 2024 Changes

Source : www.forbes.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.com2024 Tax Changes Affecting Relocation | Standard Mileage | Brackets

Source : www.neirelo.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comTax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comFederal Tax Withholding Tables 2024 Changes Your First Look At 2024 Tax Rates: Projected Brackets, Standard : It can also lower or prevent a tax bill when you file your federal tax return next year. File a New W-4 Form to Change Your Tax Withholding have changed for the 2024 tax season. . Estimated tax payments are the taxes you pay to the IRS throughout the year to account for income you’ve earned that wasn’t subject to tax withholding federal income tax return by Jan. 31 .

]]>